Rollover vs Transfer: Navigating the Terrain of Financial Transitions

What is the Difference?

Navigating the financial terrain begins with understanding the fundamental distinctions between rollovers and transfers. A rollover involves moving funds from one retirement account to another, typically between different providers, allowing you to maintain control over your investment choices. On the other hand, a transfer refers to the direct movement of assets between accounts of the same type, often within the same financial institution. Knowing these basic differences lays the groundwork for informed decision-making in managing your financial transitions.

How to Execute a Rollover vs transfer?

Executing a successful rollover vs transfer demands careful planning and adherence to specific procedures. Begin by identifying the target account, and ensuring it complies with regulatory requirements. Contact the current and receiving financial institutions to initiate the process. Submit the necessary paperwork promptly, keeping a close eye on deadlines. Stay engaged throughout the transfer, clarifying any uncertainties that may arise. A meticulous approach ensures a smooth execution, minimising disruptions to your financial portfolio.

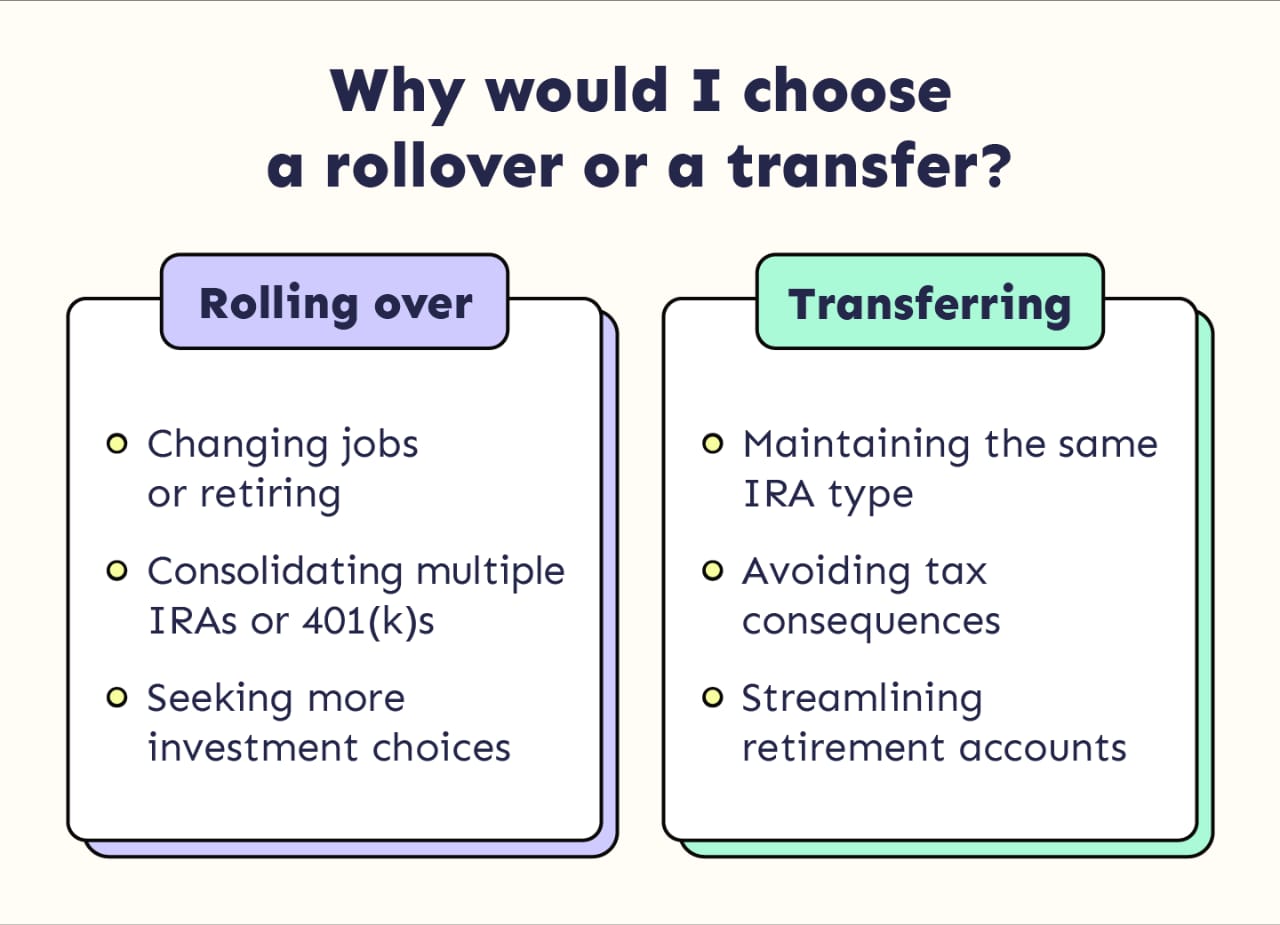

Why Choose Rollover or Transfer?

Understanding the motivations behind choosing a rollover or transfer is pivotal in aligning your financial decisions with your goals. Rollovers are often favoured for their flexibility, allowing account holders to diversify investments and access a broader range of options. Transfers, on the other hand, are chosen for simplicity and the convenience of keeping assets within the same institution. The decision hinges on factors such as investment preferences, administrative ease, and long-term financial objectives.

Tips for Successful Financial Transitions

Navigating successful financial transitions demands strategic adherence to key tips:

-

Thorough Research: Conduct in-depth research on both the current and receiving financial institutions to make informed choices.

-

Effective Communication: Ensure clear communication with all parties involved to prevent misunderstandings and streamline the transition process.

-

Preparation for Fees and Penalties: Be aware of any fees or penalties associated with the transition, and plan to mitigate financial implications.

-

Professional Advice: Seek guidance from financial professionals to navigate complexities and optimise the transition.

-

Proactive Planning: Stay proactive and well-prepared to increase the likelihood of a smooth and stress-free financial transition.

Types of Rollovers and Transfers

Exploring the diverse landscape of financial transitions involves understanding various types of rollovers and transfers:

-

Direct Rollovers: Involving the direct movement of funds from one retirement account to another.

-

Indirect Rollovers: Requiring account holders to handle funds temporarily before depositing them into a new account.

-

Trustee-to-Trustee Transfers: Occurring within accounts held by the same trustee, ensuring a seamless transition.

-

Indirect Transfers: Involving withdrawing funds and redepositing them into another account within a specified timeframe.

Common Pitfalls to Avoid

While navigating financial transitions, it’s crucial to steer clear of common pitfalls that could jeopardise your assets. Overlooking deadlines, neglecting paperwork, or failing to communicate effectively with both financial institutions can lead to delays and complications. Ignoring potential tax implications or not considering the impact on your investment strategy may result in unforeseen consequences. By staying vigilant and addressing these common pitfalls proactively, you can ensure a smoother and more secure financial transition.

Tax Implications: Rollover vs Transfer

Considering the tax implications of your financial decisions is paramount in optimising your wealth transition. Rollovers and transfers may have varying tax consequences, depending on factors such as the type of retirement account and the timing of the transaction. Rollovers are often treated as non-taxable events if completed within certain time frames, while transfers may also be tax-free if handled correctly. Understanding the tax nuances associated with each option empowers you to make decisions that align with your financial goals while minimising potential tax burdens.

Strategies for Maximising Returns

Optimising returns during a rollover or transfer involves strategic planning and a keen understanding of your investment goals. Evaluate the performance of your existing investments and consider rebalancing your portfolio during the transition. Leverage the opportunity to explore new investment options that align with your risk tolerance and long-term objectives. Additionally, stay informed about market trends and economic conditions to make timely and informed decisions. By adopting a strategic approach, you can maximise returns and position your portfolio for sustained growth in the aftermath of a financial transition.

Conclusion

Navigating the terrain of financial transitions requires a comprehensive understanding of the distinctions between rollovers and transfers. By grasping the fundamental differences, executing careful planning, and considering the motivations behind each choice, individuals can make informed decisions tailored to their unique financial goals. Armed with practical tips, awareness of potential pitfalls, and insights from real-life case studies, one can approach rollovers and transfers strategically. Ultimately, these considerations, coupled with a forward-looking mindset, empower individuals to optimise returns and lay the foundation for a secure and prosperous financial future.